Tevor Tombe, one of Premier Smith’s chosen “economists” on her What’s Next Panel published a weak critique of the VALUE OF FREEDOM, The Draft Fiscal Plan For an Independent Alberta in The Hub, a left-wing, low circulation online publication.

Mr. Tombe did not read the VALUE OF FREEDOM very carefully. His critique of the document where he refers to both the authors and the document as engaging in “fantasy” is exactly what one would expect from someone with major conflicts of interest.

He lists in his conflicts of interest disclosure as at November 25, 2024 his ongoing “Government of Canada (2022-2024) advisory and consulting services” along with numerous other Government of Canada and Alberta and other provincial paychecks. He is clearly a man with a vested interest in keeping his paymasters happy.

A perusal of his self-identified conflicts of interest begs the serious question as to how a FEDERAL GOVERNMENT “economist” was selected by Premier Smith to take part in her “What’s Next Panel”. What kind of interpretive filter does someone of Trevor Tombe’s obvious ilk serve between the people of Alberta and Premier Smith.

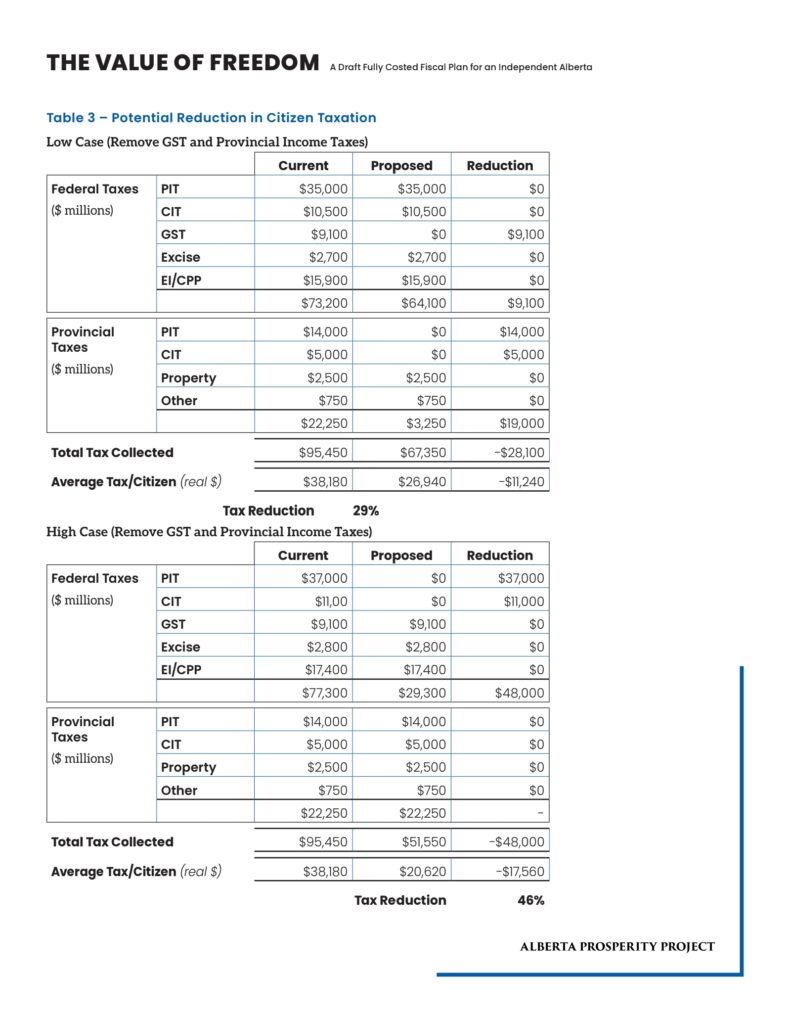

Tombes critique of THE VALUE OF FREEDOM referred to two examples of immediate tax reduction – either removing Provincial Personal Income and Corporate Income taxes and GST using the most pessimistic case ** OR** removing Federal Personal and Corporate income Taxes if we take the higher scenario.

THE VALUE OF FREEDOM intentionally used conservative Figures not wanting to overstate the already compelling case. If he were to actually read the VALUE OF FREEDOM, as opposed to only cursorily read over only the summary, in Table 3 he would see the two separate cases outlined and understand that our base case was one **or** the other. Not both.

Both are plausible and immediate. We’d likely choose the lower one to start with.

This is without even using the updated provincial numbers which are about $15B extra provincial resource revenue compared to the sources used in the VALUE OF FREEDOM.

…and no, we do not include CPP revenue or expenses in that. StatsCan keeps them separate and so do we.

It’s not until we unleash the economic might of an independent Alberta as postulated in the last section where we clearly state that we, just for fun, examined an aggressive case, beyond the much more conservative cases considered in the rest of the document and imagined if Alberta exploited its natural resources in much the same way that other nations possessing significant oil and gas deposits have exploited theirs and garnered enormous economic gain for themselves.

Danielle Smith herself has suggested additional pipelines represent $20B added government revenue per pipeline, we postulate two more, allowing a tripling of volumes to be exported to an oil hungry world.

Then, we had a bit of fun….what could we do with that money?

Personal income taxes? Gone

Property Taxes? Replaced with a user fee.

Corporate taxes? Slashed to 10%

Other benefits? Many and good.

But feel free to speculate what you’d do if your country had that amount of extra revenue….keeping in mind that governments are a parasite on those who actually create the wealth and earn the money and letting the wealth creators keep more of it is a virtuous cycle, very different than the one exercised by the “tax and spend” approach used throughout Canada today.

As for the concern about tariffs and business with the rest of Canada, the flawed assumption is that we’d actually want to keep buying expensive Canadian goods.

Isn’t Trump pushing for no tariff zones with countries?

Why would an independent Alberta not welcome a tariff free zone with the USA and increase our share of north south business from its current 70% to 90% or more? The USA makes pretty well everything we need and certainly we can import through the USA rather than facing punitive tariffs from a petulant rump of Canada.

You really think that the pipelines through Saskatchewan would be tariffed? Seems to me that would pretty well be enough incentive for Saskatchewan to leave the sinking ship Canada and join with the rising star of Alberta, and together we make an even more powerful nation.

…and perhaps we ought to tariff rail and road traffic crossing Alberta land. Not much, just enough to offset any deviltry done by a grumpy Canada.

As for people fleeing Alberta, seems like more people are coming here from the rest of Canada already – surely a much lower taxed country would only attract still MORE talent, and we’d need every one of them to build the economy and diversify it. Remember, Alberta is roughly the size of the Ukraine and they were home to 44 million pre-war – so we have the space certainly.

Large scale data centres for AI – it’s wonderful in Alberta with low taxes, low energy costs and natural cooling courtesy of a cool climate.

Specialized manufacturing? Nice thing to do here with a tariff free zone to the world’s largest market.

We never really got into all the things we could do as an independent country – the case was plenty compelling as it stands.

Simplify our tax code – go to consumption-based taxes, eliminating most of the tax collection department and legions of accountants who pore through income tax statements now that we collect tax surely and easily at point of sale.

Clear out the bureaucrats who chase down obscure government of Canada regulations, now replaced with “Made in Alberta” regulations which are simpler, easier to live with and less onerous.

Mr. Tombe needs to internalize that the case for a FREE AND INDEPENDENT ALBERTA is compelling.

Are there numbers which we need to tune? Yes, we are hard at it….we’ll get the Defense up to NATO standards, we will bake in OAS, GIS and other supports for seniors, CCB is already in there. But have no doubt, a country with the aggressiveness of Alberta will grow, thrive and have plenty of economic capacity to do all those things with ease.

A free Alberta is a wealthy Alberta. Come join us.

Jeffrey R. W. Rath, B. A. (Hons), LL.B. (hons)

Dennis P. Kalma, B.SC. Physics (Distinction)

Foothills, Alberta

July 26, 202